Two Paths to Tax-Efficient Diversification: Exchange Fund and Tax-Aware Long/Short

As tax-efficient investing has grown, two strategies keep showing up in the same conversation: Exchange Funds and Tax-Aware Long/Short. Investors ask us how these two products compare and which one they should use.

A good plan usually doesn’t start with “Which product should I use?” It starts with a more nuanced question: “Which product works best for each lot of the stocks I own?”

At Cache, we’ve seen thousands of concentrated portfolios. Most positions were built over decades through grants, vesting, and purchases. You don’t actually have one position; you have a stack of tax lots, each with a different cost basis and tax constraint. In our opinion, the most effective diversification plans work lot by lot, using different tools for different shares in a deliberate sequence.

The two problems you’re actually trying to solve

Before diving into the products, it helps to separate the problems.

1. Concentration risk (A structural problem)

When one stock dominates your net worth, the risk is profound. A large drawdown doesn’t just affect returns over the next few years; it can permanently alter your financial future.

Selling outright eliminates the risk, but for low-cost-basis stock, it often creates a tax bill large enough that many investors feel locked in.

2. Tax drag (A recurring problem)

In a strong market, capital gains are a reality for many high-net-worth investors. Portfolio rebalancing, stock sale plans, fund distributions, and secondary sales of private shares can generate ongoing capital gains. Over time, that tax drag quietly reduces the amount of capital working for you.

These are different problems. They require different solutions.

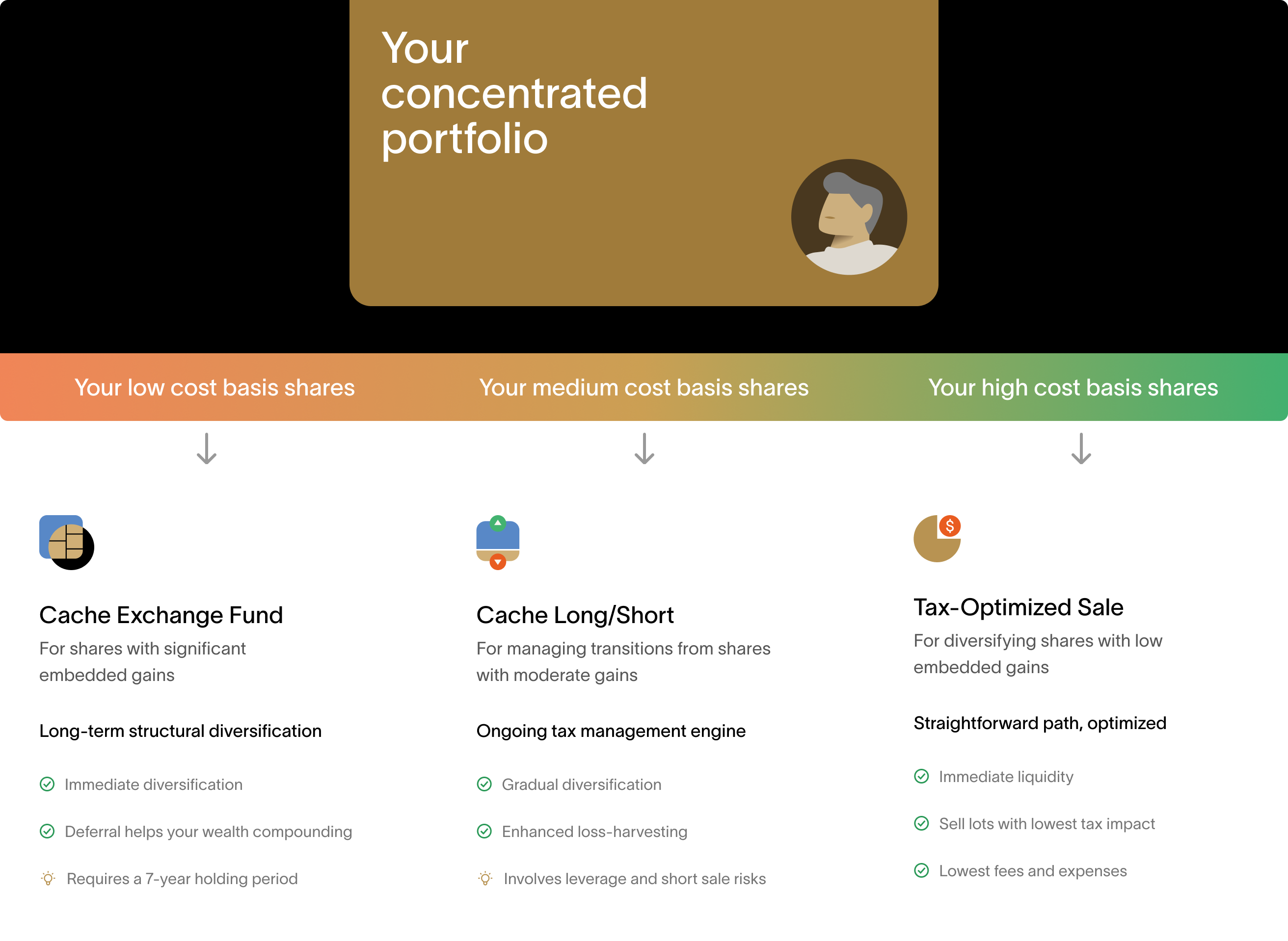

Different tools for different lots

As we’ve seen in our clients' portfolios, most concentrated portfolios aren’t uniform. They often contain a mix of the following:

- highly appreciated lots where selling is expensive and traditional tax-loss harvesting has limited utility

- moderately appreciated lots that can often be unwound gradually with a tax-aware plan

- high-cost-basis lots where taxes aren’t usually a constraint

Trying to solve all of these with a single strategy can create unnecessary trade-offs. The more effective approach is to match each lot to the tool it’s best suited for, and use those tools as part of a larger strategy.

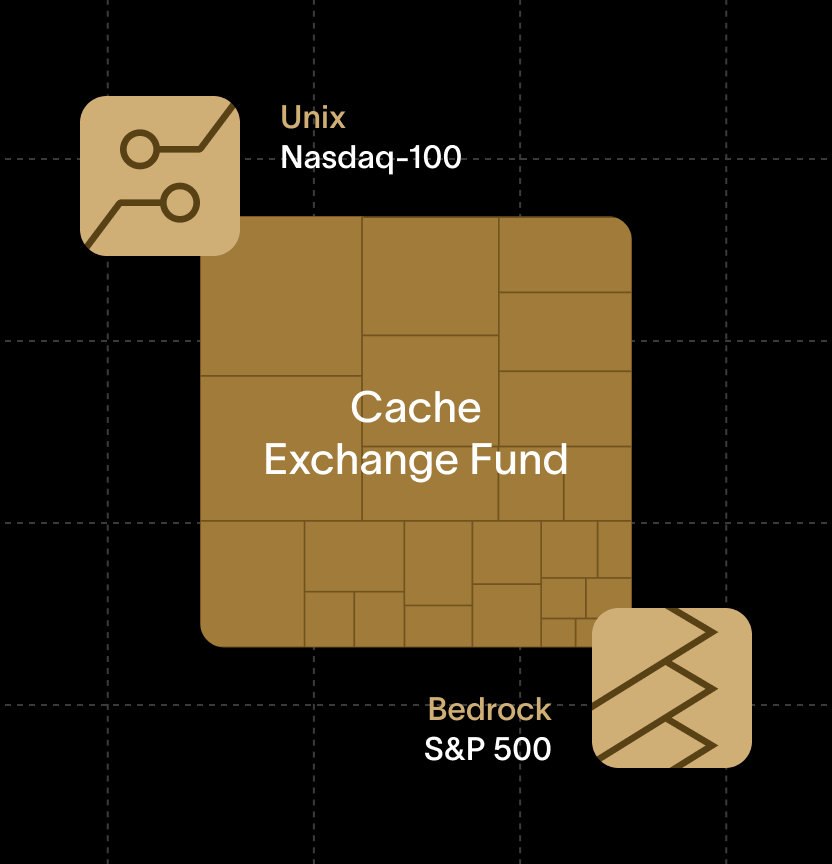

Understanding the role for Exchange Funds

Exchange Funds are designed to address structural concentration.

By contributing highly appreciated stock to a diversified fund, investors can reduce single-stock exposure immediately while deferring capital gains taxes.

Exchange Funds tend to work best when:

- Embedded gains are very high

- The tax cost of selling would be material

- You’re comfortable committing to a long-term investment

They’re often used as the foundation of a diversification plan, one that doesn’t require frequent adjustment.

There are a few important risks and constraints you need to understand before you invest:

- Illiquidity: Shares must be held for seven years to receive a diversified basket.

- Tracking error: Exchange Funds are benchmarked to an index but do not replicate its performance, which can lead to differences relative to public benchmarks.

- Qualifying asset exposure: Real estate may introduce uncorrelated risk.

- Tax law risk: Deferral depends on current tax rules, which may change.

- Acceptance limits: Contributions may be restricted if a stock becomes overweight.

Exchange Funds are powerful by design, but intentionally inflexible by law. That is the tradeoff.

👉 Read our complete guide to exchange funds

Understanding the role of Tax-Aware Long/Short

Tax-Aware Long/Short strategies are designed for tax-efficient transitions.

By combining long exposure with short positions, these portfolios expand the set of positions that may realize losses. This can create opportunities to harvest losses across a wider range of market environments, not just broad market downturns.

Those losses may then be applied against realized gains — often from staged sales of a concentrated position, rebalancing, or other recurring taxable events.

Tax-Aware Long/Short strategies tend to work best when:

- Appreciation is meaningful but not extreme

- Diversification can happen gradually, over years or decades

- Liquidity and flexibility are important

- You’re comfortable with leverage and short exposure

A practical rule of thumb

Long/short can be useful when there’s enough embedded gain to matter, but not so much that the strategy becomes a decade-long project.

For example, let’s assume you’re working with a $5M concentrated position:

- $2M of embedded gain: it may be possible to work down meaningfully over a few years using loss offsets (depending on markets, sizing, and your tax situation).

- $4M–$5M of embedded gain: a long/short approach may require a much longer horizon, increased leverage, or both, elevating your portfolio risk.

This is one reason long/short is often most effective after the most deeply appreciated lots have been addressed structurally.

Constraints and risks to understand

A tax-aware long/short strategy has real risks and requires sophisticated execution:

- Leverage risk: borrowing against a portfolio can introduce margin-call risk in sharp declines.

- Short exposure risk: short positions can produce significant losses if a stock rallies or squeezes.

- Financing and borrowing costs: margin and borrow costs are market-dependent and can rise quickly.

- Loss generation variability: realized losses depend on market conditions and portfolio configuration.

- Tax law risk: benefits rely on current tax rules, which may change.

A tax-aware long/short is not a passive strategy. It requires experienced judgment and sophisticated execution, given the sheer number of moving parts.

👉 Read our complete guide to tax-aware long/short

When investors could use both

Once you separate structural concentration from tax management during transitions, the combination becomes intuitive.

- Exchange funds handle the lots that should be diversified now, but are too expensive to sell.

- Tax-aware long/short helps manage the remaining lots, and supports staged sales, liquidity needs, and ongoing tax planning.

A thoughtful plan considers the problem at hand and can often use both: one to reduce risk immediately and one to manage taxes as the rest of the portfolio evolves.

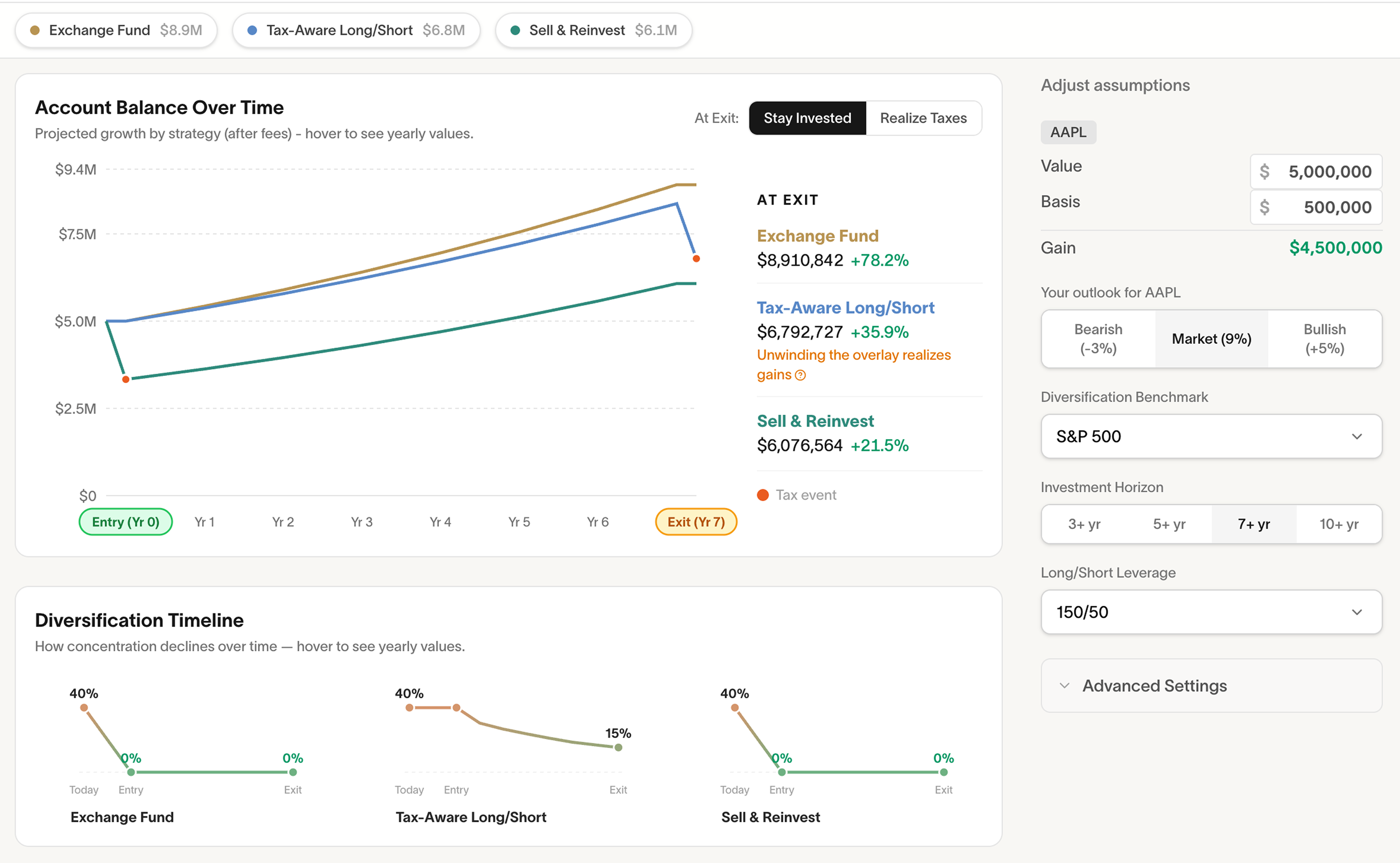

Quantifying the tradeoffs

Frameworks explain why. Numbers explain how much.

We built a calculator that lets you:

- Compare Exchange Funds, Tax-Aware Long/Short, and selling side by side

- Adjust tax rates, time horizons, leverage, and market assumptions

- Model blended approaches across different lots

👉 Run the calculator to compare outcomes under your assumptions

The takeaway

Managing concentrated stock isn’t about picking the “best” strategy.

It’s about:

- Matching tax lots to tools

- Sequencing decisions deliberately

- Understanding the trade-offs

“Different tools for different lots” is a distillation of how many of our sophisticated clients actually diversify.

If you’re navigating concentration, taxes, and timing, Cache offers a set of complementary tools to help – the Cache Exchange Fund and Cache Long/Short.