Why Exchange Funds Hold Real Estate: The 20% Qualifying Asset Rule, Explained

How Cache uses institutional real estate to meet tax code requirements and support long-term stability

When people think about exchange funds, they usually focus on the headline benefit: diversifying a concentrated stock position without triggering taxes. But behind that benefit is a structural requirement that makes the entire system work: the qualifying asset.

It isn’t a marketing feature, and it isn’t optional. It’s a core part of the tax code.

Every exchange fund must hold at least 20% of its total assets in qualifying illiquid assets to preserve tax-deferred treatment when investors contribute appreciated stock. Most funds meet this requirement with real estate.

Here’s why the rule exists, how Cache meets it, and how today’s approach improves efficiency, diversification, and scale for both advisors and investors.

.png)

Why Qualifying Assets are Required

Under Internal Revenue Code Section 721, an exchange fund must hold at least 20% of its total assets in qualifying assets, typically real estate or partnerships that own real estate. To meet this requirement, the fund must own the underlying asset—either directly or through a properly structured partnership.

Important: Publicly-traded REITs do not qualify for this rule. They may be attractive investments, but they do not meet the tax code structuring requirements for exchange funds.

What the Real Estate Allocation Looks Like

Cache invests its qualifying asset allocation through institutional private real estate limited partnerships, currently with funds benchmarked to the NCREIF ODCE Index, the institutional standard for core U.S. real estate.

These partnerships offer broad diversification, stable income from tenant cash flows, and professional management. Cache’s philosophy is to take only the amount of real estate exposure needed to support a non-taxable equity contribution or redemption.

The goal is simple: keep risks low, cover costs, provide stability, and let real estate be a modest tailwind over a full cycle.

The NCREIF ODCE Index

The ODCE Index tracks large institutional real estate portfolios owned by pensions, endowments, and foundations. These portfolios share three traits:

- Stabilized, income-producing properties

- Independent quarterly valuations and appraisals

- Diversification across major U.S. markets and property types

Historically, ODCE strategies have delivered roughly 6.9% annualized net returns since inception (*), driven mostly by income. Think of ODCE as a real estate counterpart of indices you might be familiar with, like the Nasdaq-100 or the S&P 500. *Returns are since inception net of fees from Q1 1978-Q3 2025

In short: Cache’s real estate allocation mirrors the institutional core market: diversified, stable, and income-oriented.

Institutional Partners

Cache sources qualifying asset exposure through partnerships with LaSalle Investment Management and TA Realty, two of the most established real-estate managers in the United States. Cache continues to evaluate additional partners and has a strong pipeline of future options.

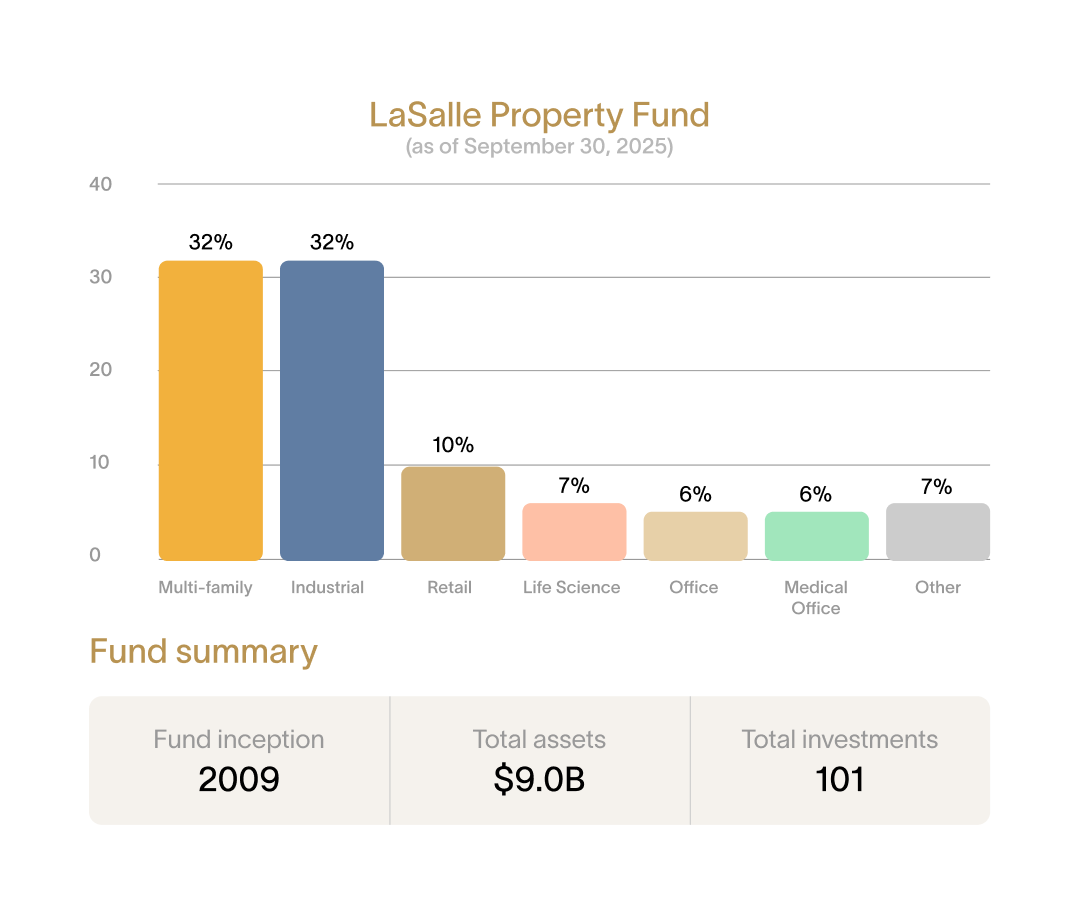

LaSalle Investment Management

Founded in 1980, manages $89B in global real estate

Fund Name: LaSalle Property Fund

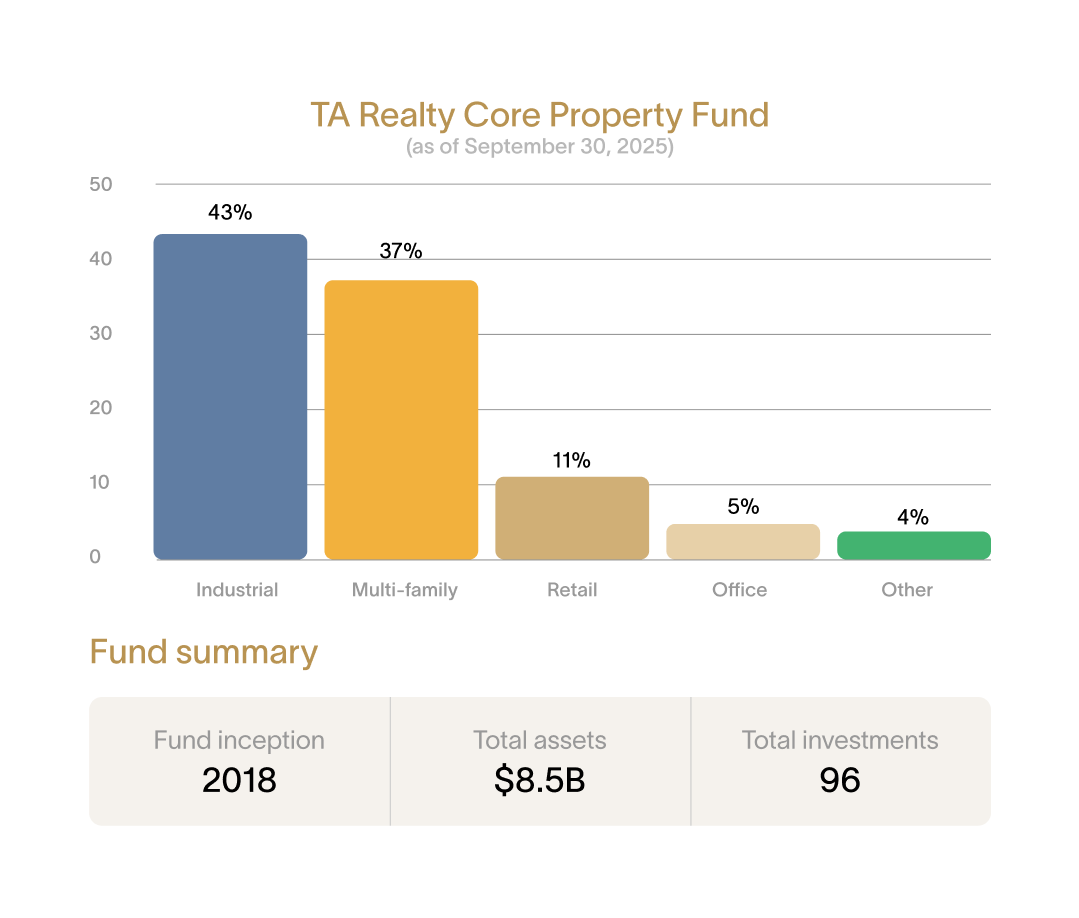

TA Realty

Founded in 1982, manages $14B in U.S. real estate

Fund Name: TA Realty Core Property Fund

Portfolio Characteristics

Together, these managers provide access to hundreds of stabilized, income-generating properties:

- Industrial/logistics: 40–45%

- Multifamily: 30–40%

- Remaining mix: office, retail, medical office, life sciences

Each partnership is independently valued quarterly and audited.

In essence: Cache provides exposure to institutional-grade real estate: diversified, professionally managed, and built for consistency.

{{black-diversify}}

The Evolution of Real Estate in Exchange Funds

Traditional Approach

For decades, many exchange funds have met real estate requirements through direct property ownership.

Managers typically acquired one or more individual properties, such as multifamily and office, around the time investors contributed stock. These purchases were coordinated with fund formation and contribution windows.

This structure was common and compliant, but it reflected how exchange funds were built when participation was infrequent.

Some historical considerations were:

- Timing constraints: Property purchases were tied to specific fund events.

- Concentrated exposure: Funds may have held only a handful of properties, depending on the structure.

- Infrequent onboarding: Investors joined during limited (typically quarterly) acquisition windows.

The traditional approach worked, but it was operationally bespoke by design.

Cache's Modern Approach

Cache takes a different path.

Instead of buying individual buildings, Cache obtains real estate exposure through established institutional real estate funds. These portfolios are managed by third-party firms whose primary focus is real estate investment and operations.

Cache designed this structure to support consistency, diversification, and the repeatable formation of funds.

Key elements include:

- Broader diversification: Exposure across many properties, sectors, and regions.

- More flexible: Investment amounts can be tailored to match incoming stocks

- Faster onboarding: Predictable, bi-weekly onboarding for investors, and real estate is typically acquired quarterly.

This approach preserves the core tax framework of an exchange fund, while modernizing how qualifying assets are sourced and managed.

How Exchange Funds Finance the Real Estate Allocation

Every exchange fund uses a credit facility to finance its qualifying asset exposure. This keeps contributed stock fully invested and preserves tax deferral.

How it typically works:

- After each close, the fund borrows cash from a credit facility.

- The cash is invested in institutional real-estate partnerships.

- No contributed stock is sold.

- The fund remains fully invested and IRS-compliant.

Understanding the 20% Rule

Because the fund borrows to create exposure, the portfolio becomes:

- 100% equities

- +25% real estate (from borrowing)

- = Real estate represents 20% of total assets

Example: Investor contributes $1M in MSFT stock.

The fund borrows $250K and invests it in real estate.

Total portfolio = $1.25M → real estate is exactly 20%.

Important: After this point, equity and real-estate price movements do not affect the 20% requirement under current guidelines. No additional real estate is required due to market fluctuations.*

Qualified Redemptions After Seven Years

After the required seven-year period, investors can redeem their fund interest and receive a diversified distribution of publicly traded securities (if eligible, typically ETFs and stocks).

- Real estate typically remains inside the fund to support future investors for funds that are still taking new subscriptions. It is not typically distributed in redemptions.

- If real-estate exposure drifts above target, Cache has the ability to use quarterly redemption windows, typically quarterly, with its managers to rebalance.

This process keeps the fund stable, compliant, and tax-efficient.

Bringing It All Together

The real-estate component of an exchange fund is not a side investment. It is the foundation that makes the entire structure possible.

By pairing equity diversification with institutional real estate, Cache offers a modern exchange-fund approach that is designed to be:

- Faster to onboard

- Professionally managed

- Diversified across markets and property types

- Fully IRS-compliant

- Designed for long-term tax efficiency

In short: modern exchange funds combine market participation and tax deferral, backed by institutional-grade real estate.

LaSalle and TA Realty Chart Disclosure

The information provided for informational purposes only and is based on manager-reported data from LaSalle Core Property Fund, L.P. and TA Realty Core Property Fund, L.P., including the most recent quarterly reports made available by each manager. Cache is not affiliated with, sponsored by, or associated with LaSalle Investment Management, Inc., TA Realty LLC, or any of their respective affiliates. Neither LaSalle nor TA Realty has endorsed, approved, or reviewed this material, and the data is unaudited.

Sector classifications (including Industrial, Multi-family/Residential, Retail, Office, and Other) are derived from each fund manager’s internal portfolio reporting and classification methodologies and, where necessary, have been normalized for consistency. Classification methodologies may differ between managers and may change over time due to portfolio activity, reclassification, or updated manager reporting. The “Other” category may include specialty or niche property types, such as medical office, life science, self-storage, or data center assets, depending on the fund.

Fund Inception date for TA Core Real Property Fund is March 27th, 2018. The inception date for LaSalle Core Property Fund is 3Q 2010. Total Assets refers to the Total Gross Assets of the most recent reporting period, and total properties refers to the most recently reported figures provided by the fund manager. All figures reflect the most current data available at the time of presentation, are unaudited, and are subject to change without notice. Portfolio composition percentages may not sum to 100% due to rounding.

No representation is made as to the accuracy or completeness of third-party information, and Cache does not independently verify manager-provided data. Investors should conduct their own due diligence and consult their own legal, tax, and financial advisers before making any investment decisions.

Additional Important Disclosure

The information presented herein is based on sources believed to be reliable; however, its accuracy and completeness are not guaranteed, and it should not be relied upon as a definitive representation of any fund, strategy, or investment outcome.

The comparison between Cache’s Modern Approach and a traditional direct real estate ownership approach is provided for illustrative and structural comparison purposes only. It is not intended to represent a comparison of performance, risk-adjusted returns, or investor outcomes, nor does it imply that one approach is superior to another in all circumstances.

Investing in interests of private real estate funds may be more or less expensive than investing directly in real estate. Fund investments typically involve management fees, incentive allocations, operating expenses, financing costs, and other fund-level expenses that may not be incurred, or may differ in amount and structure, in a direct real estate ownership model.

Private real estate fund investments also differ materially from direct real estate ownership with respect to liquidity, control, valuation methodology, leverage, and redemption rights as well.

Any discussion of tax considerations, including references to exchange fund qualification, the “20% rule,” or tax deferral, is provided for general informational purposes only and does not constitute tax advice. No assurance can be given that any particular tax outcome will be achieved, and tax treatment may vary based on individual circumstances, changes in law, or regulatory interpretation. Investors should consult their own tax advisers regarding the tax consequences of an investment.